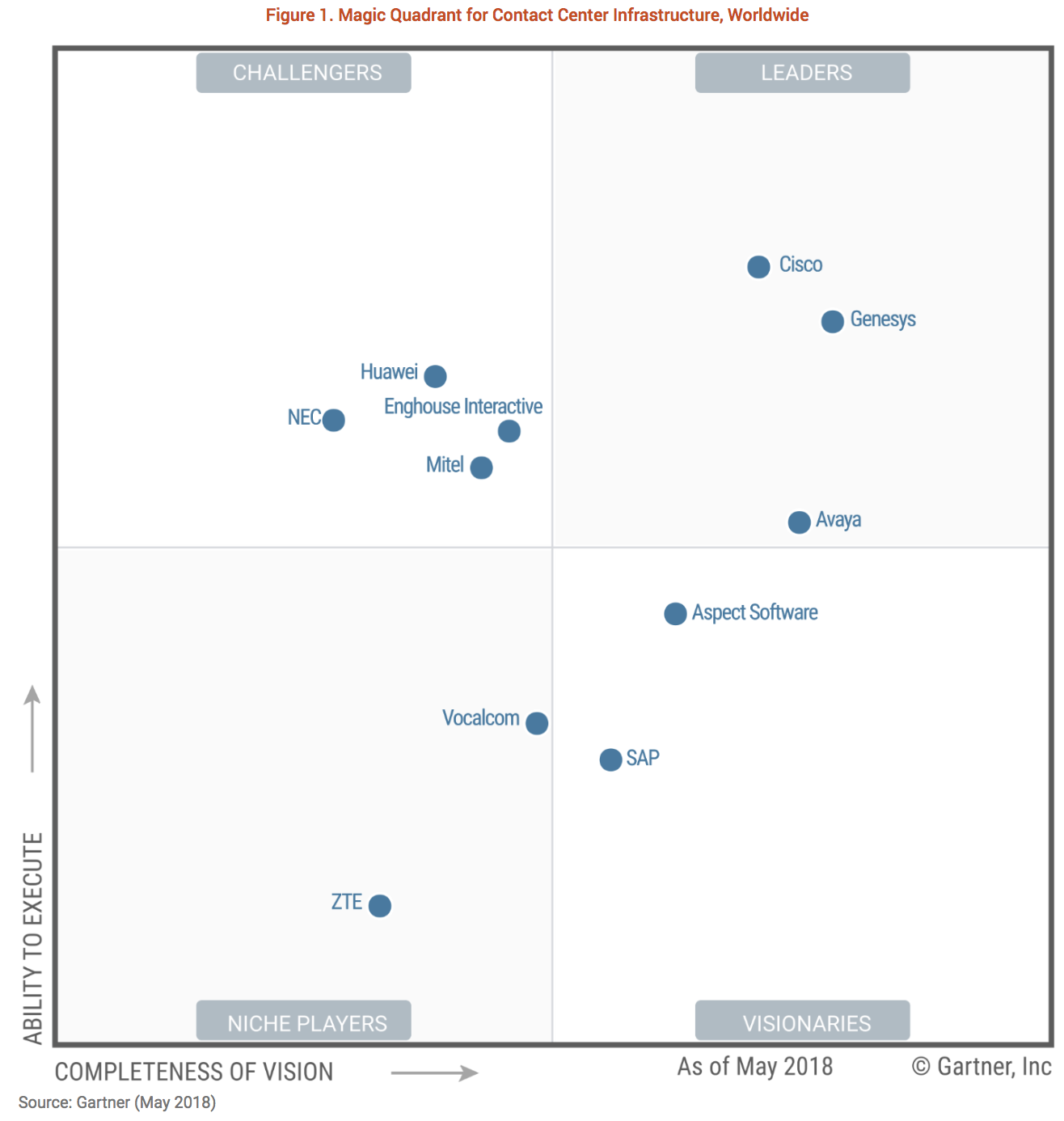

Usually, around this time of the year, the CX industry awaits reputable reports by Gartner on the state of the players in the industry. Gartner releases two reports, one for Contact Center Infrastructure (CCI) and the other is for CRM Customer Engagement Center (CEC) .

The way Gartner differentiates between the two is:

“Contact center interactions can be people-assisted or automated self-service, using web chat or interactive voice response (IVR) and speech recognition technologies, for example. They can also be a combination of assisted service and self-service. Channels for interaction use both live agents and messaging technology, and include voice, web, email, instant messaging, web chat, social media, video and mobile applications. Although there can be significant technology overlap between the CCI market and the CRM CEC market, the CCI market has three unique characteristics:

Solutions in the CCI market are often an extension of a unified communications (UC) technology portfolio. Although these solutions can route multichannel interactions, voice and telephony tend to play an important role.Although CCI solutions include tools for integrating with CRM and other enterprise software packages, they do not typically include this functionality in their own solution stack.Voice and data network performance and cost issues are often key elements in the design of architecture and solutions.

In contrast, CEC solutions are most frequently an extension of CRM platforms’ case management and problem resolution capabilities. While these solutions also route multichannel interactions, they tend to focus on channels other than voice, and they support a strong focus on using existing customer data to optimize interactions based on the customer’s apparent desired outcome.”

So, without further introductions, lets start looking at the Magic Quadrant For Contact Center Infrastructure first. (For full report, please contact Gartner)

At first glance, you will find that (Cisco & Genesys) are in the leading visionaries quadrant, two vendors that IST works with. Reviewing this in alphabetical order,

Cisco

as per Gartner Cisco’s strength comes from:

Cisco’s strong financial backing and renowned brand combined with an unparalleled partner network, Cisco’s recent acquisition of Broadsoft with its CC-One Cloud contact center. We at IST believe the market is heading to cloud and once Cisco start rolling out this part of its standard Contact Center Business Unit product offering, it will be a game changer in the cloud market Gartner views Cisco’s Finesse web based agent desktop as one of its key strengths, considering that it is a web based framework that is easily connectable to any CRM or third party system.

Genesys

as per Gartner Genesys’s strength comes from:

well-defined approach when it comes to separating the contact center applications from the telephony infrastructure. Meaning that, unlike most vendors where they would copy the telephony infrastructure part of their offering, Genesys has an telephony agnostic approach. Genesys recent acquisition of AltoCloud, which uses machine learning to predict customer journey on the digital channels. I, myself have seen a demo of this solution and using the word revolutionary might be an understatement.

Genesys PureCloud & PureConnect which are part of Genesys recent acquisition of Interactive Intelligence are resonating well with the SMB market. At IST see that specifically true within the Middle East region with specifically PureCloud.

Moving onwards to the next Magic Quadrant for the CRM Customer Engagement Center

We share Gartner’s vision that at some point in the future that both the CCI and CEC quadrants should be merged, Maybe even sooner than expected. Here we would see the likes of eGain and Verint, both customer engagement companies in the same graph as for example Salesforce which is both a CRM and a customer engagement company. Within this blog, we will focus on IST partners both Verint and eGain.

eGain

as per Gartner eGain’s strength comes from:

eGain’s strong offering in knowledge management coupled with its AI and Virtual assistanteGain’s try and buy which has a very high conversion rate of 70%, which echos the confidence in the product lineeGain’s client where really happy when it comes to eGain’s team knowledge, expertise and responsiveness.

Verint

When it comes to Verint, Gartner focused on its Engagement Management system, which is a unified platform for knowledge management, process management, case management, mail management, live chat, co-browse, social listening and analytics, and social community. It provides a holistic approach to customer service by combining knowledge, process, data, and channels into a unified application. It can give your organization strength and depth in its customer service capabilities and help you deliver an exceptional experience to customers on all channels across the globe.

As per Gartner, Verint Customers appreciated the strenght of the knowledge management within the portofolio Already Verint offering when it comes to self service was strong, but with its recent acquisition of Next IT, its boosted it even moreVerint’s is a profitable company, with a sizeable install base, along with a good development team. This usually mean the company has a good future ahead of them.

If you would like more information on any of the above mention vendor or how can IST help your organisation with its CX strategy please contact us here

Recent Posts